Presenting Ken Abbas

Invest In Clarity Not Confusion,

Because Real Solutions Are Not Free

Let’s transform your debt into a strategy that works for you, without the sales pitch or hidden costs.

Why Choose Me?

No Traditional Programs, Just Real Results

Most debt settlement companies lock you into 4-6-year plans with hefty fees. These companies may claim “free consultations” but rarely offer unbiased solutions, they’re selling a program. With me, you get straightforward, professional advice. My approach is different: you’ll understand every option, every fee, and the exact impact on your debt from someone who knows the game within the game. Visit My Portfolio Website!

True Resolution for a Small Fee

My consultations aren’t free, but they’re also not about selling you on a program. This paid consultation is your chance to understand all your real options, with no pressure or pitches.

Affordable Expertise, From a Global Perspective

As someone based in Pakistan with years of direct experience, while working with U.S.-based debt settlement companies, at a fraction of their costs. Most companies charge 20-30% of the debt amount and others charge 20-30% on savings, either way, you are not saving maximum. I charge 10% on savings not on total debt and offer One Time Paid Consultation and DIY (DO IT YOURSELF DEBT SETTLEMENT).

Featured on:

Real Clients, Real Experiences

How they turn financial confusions into clarity!

Why I’m Different

Tired of debt relief companies that sell you on long programs and take a big cut? I’m here to provide real solutions without the sales pitch.

Here’s why I stand out:

Real Solutions, No “Free” Consultations

I don’t lure you in with “free” advice that turns into a program pitch. My consultations are paid, designed to give you honest, actionable guidance from the start.

Industry Insider with Current Insights

I’m still active in debt settlement, so I bring you up-to-date knowledge and practical options, not outdated strategies.

Flexible Support, DIY or Full Assistance

Prefer to handle things yourself? I’ll guide you through it. Need someone to manage the negotiations? I’m here to help. Either way, you get control over the process.

Transparent and Affordable Fees

While traditional companies take 20-30% of your debt or savings, I charge only a 10% fee on savings if I negotiate your debt, or you can schedule an hourly paid consultation for guidance.

Skip the gimmicks and get straightforward, affordable solutions. Book a consultation to see the difference a real industry expert can make.

Global Expertise, Not U.S.-Based Overheads

Working from Pakistan lets me offer high-quality debt relief support without the inflated costs of U.S.-based firms.

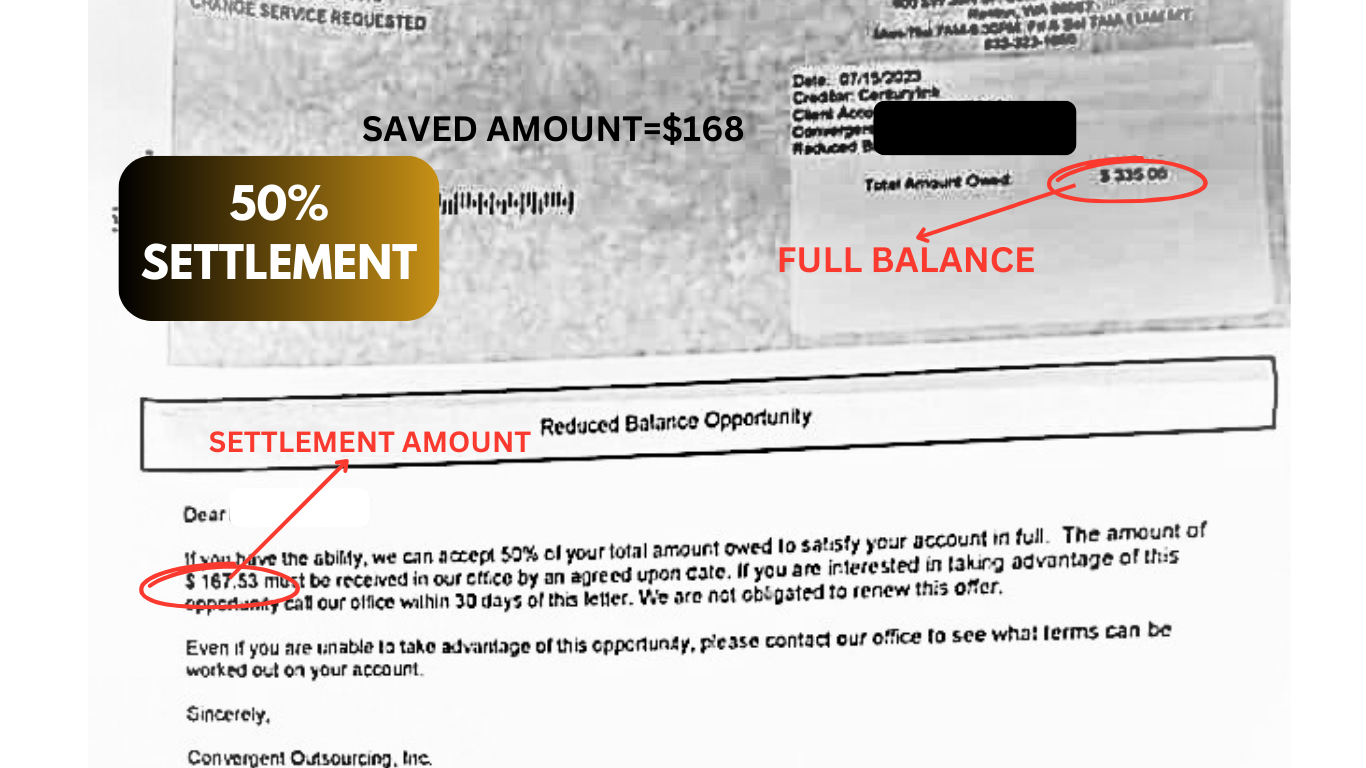

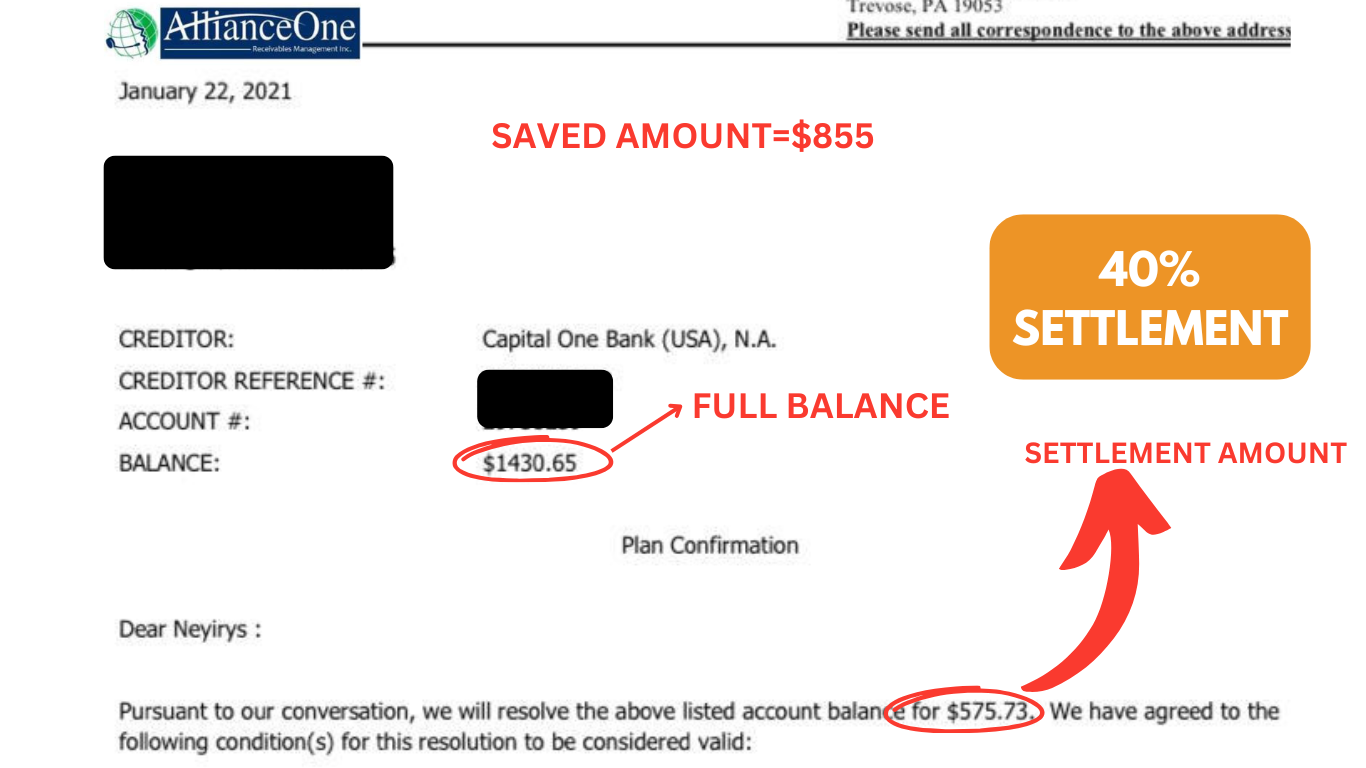

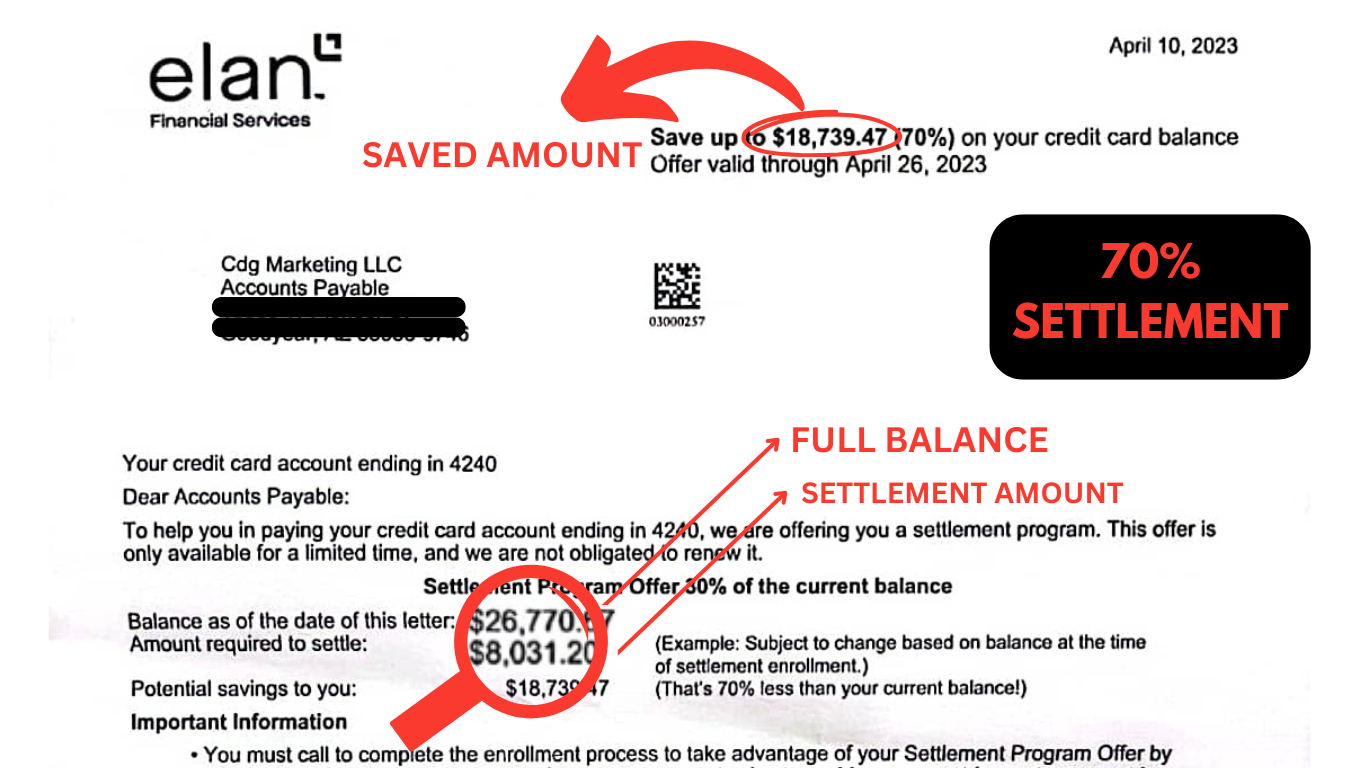

Examples of Successful Settlements

This could be you!

My Approach is Different

Unlike typical debt relief companies, I’m here to solve, not sell. As a top-rated consultant on Upwork, I bring real experience to the table, without pushing programs or locking you into years of fees. Instead, I provide a clear path to debt freedom tailored to your unique needs and goals. Clarity is key, so I walk you through each step, no guessing, no surprises. Together, we’ll tackle your credit issues head-on, whether it’s negotiating settlements or building a strategy to pay off debt. They Sell. I Solve. It’s up to you. Others Sell. I Solve. Its up to you.

Wanna Make a Smart Move?

Phase 1

Understand why contacting me directly offers more value and clarity than relying on a typical debt relief company.

Phase 2

Learn from my clients’ experiences and see why they believe in this approach.

Phase 3

Let’s have a conversation. Get expert guidance, resolve your financial challenges, and potentially save thousands in the process.

They Sell, I Solve

It’s not rocket science. You could listen to endless sales pitches and hope you stumble upon a good option. Or, you can come to me, and I’ll give you a straightforward, logical solution to your problem—without the sales pressure.

Find Clarity and Confidence in Your Finances

Catch this brief video to see how my distinct method can help you sort out your finances and get ready for what’s next.